foreign gift tax uk

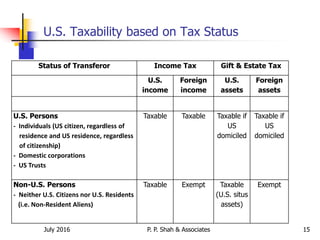

Treaties with estate andor gift tax provisions can be found at the International Bureau of Fiscal Documentations Tax. On the other hand non-US.

Transfer Money From Overseas To Uk Tax Implications Moneytransfers Com

Before the finance act.

. Then this will need to. You can be subject to a penalty equal to 5 but not to exceed 25 of the amount of the foreign gift or bequest if youre required to file Form 3520. The general rule is that you can gift up to 3000 tax-free each tax year.

The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle. HMRC calls this the annual exemption. But a key exception is when a foreign person Non-Resident Alien or NRA gifts US.

Before the finance act. Even though there are no US. 1 IRM 425441 paragraph 2 was revised to provide current instructions for requesting FATCA data in estate and gift tax examinations.

For purported gifts from foreign corporations or foreign partnerships you are required. Gift 350000 Minus the Inheritance Tax threshold on 27 March 2021 325000 Amount on which tax can be charged 25000 Tax on the gift at 40 25000 X 40 Tax due. Gift transfers to the UK.

There will be no income tax due on the gifting of money. As to the taxation of foreign gifts the general rule is that gifts from foreign persons are not taxed. 24th Feb 2020 1359.

How much money can you receive as a gift from overseas UK. If you happen to receive money from a foreign corporation or partnership as a gift and it is above. If the gifts or bequests exceed 100000 you must separately identify each gift in excess of 5000.

Donations tax is payable by the donor and not the recipient - therefore there are no tax implications for you however you need to disclose it in your tax. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on form 3520. Again it is simply a declaration.

16 rows Estate Gift Tax Treaties International US. However if you are UK tax resident and you make a capital gain abroad from the sale of a property. 13 April 2016 at 938.

Penalties for Not Timely Filing. You will not have to pay tax on this though. You can send money to UK residents without incurring taxes if the funds are a gift as HMRC does not view gift transfers as a form of income.

Domiciliaries also enjoy a large unified gift and estate tax exemption on the transfer of their assets which is equal to 117 million in 2021 4. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on form 3520. Find out whether you need to pay UK tax on foreign income - residence and non-dom status tax returns claiming relief if youre taxed twice including certificates of residence.

In the UK there are three rates of income tax which would be apply to an individuals income in a tax year starting at 20 for an income of 31785 or lower 40. Tax ramifications on the initial receipt of a gift from a.

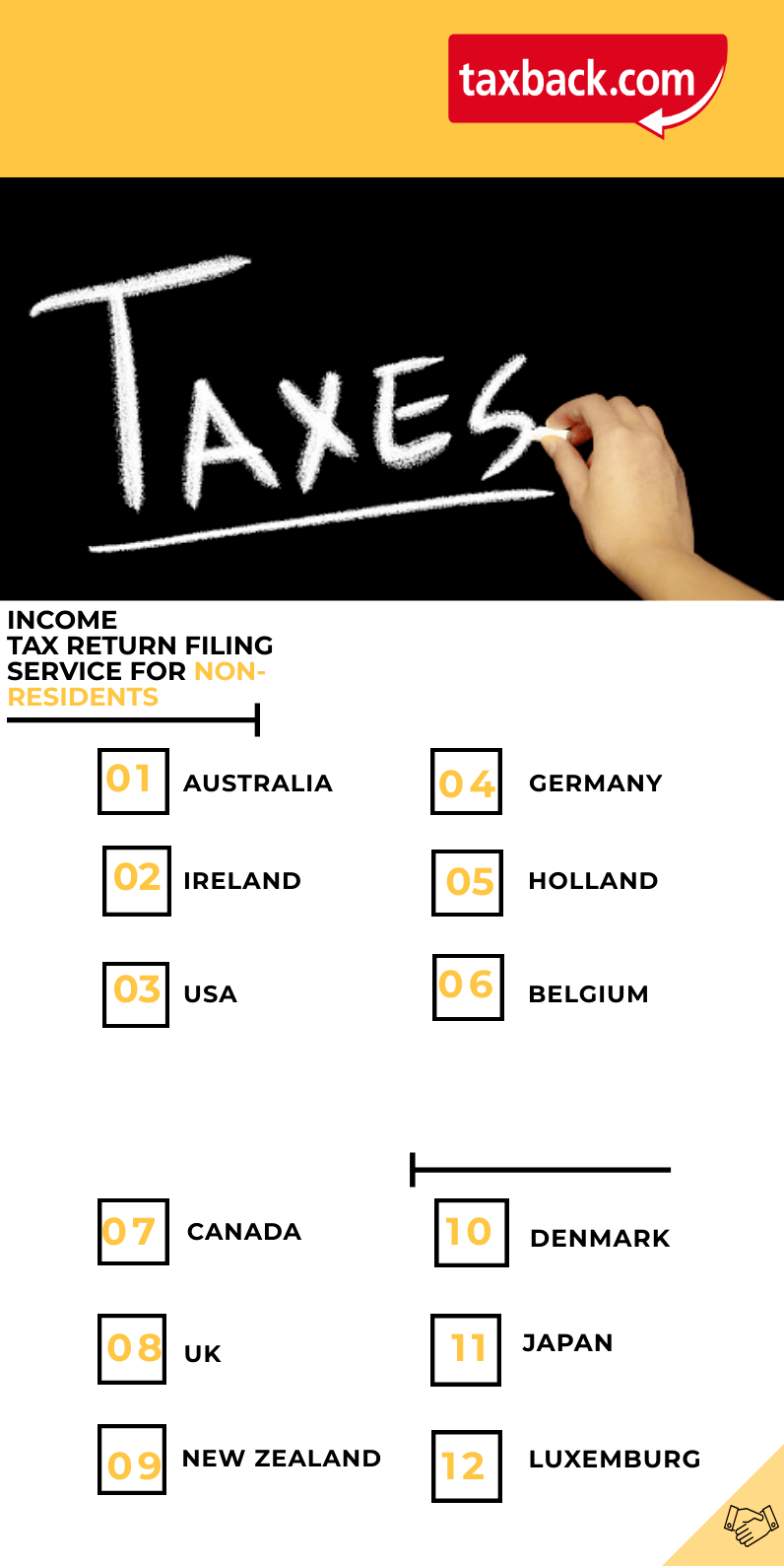

Declaring Foreign Income In Canada

Tax Implications On Money Sent To India From The Uk Compareremit

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

The Us Uk Tax Treaty Explained H R Block

How Are Gains On Foreign Stock Investments Taxed Forbes Advisor India

What S The Limit On Cash Gifts From A Nonresident Alien

Do I Have To Pay Uk Tax On My Foreign Income Oxford Accountants

Making A Cross Border Donation From The United Kingdom Transnational Giving Europe

30 Gift Ideas For Expat Friends Family Overseas Or Moving Abroad Migrating Miss

Hot Awkward Turtle Like Cards Against Humanity Aid Taboo Together Cards Gift Uk Poker Card Games We7305424

Tax On Money Received From Abroad To India Oct 2020 Wise Formerly Transferwise

Inheritance Tax Rules On Gifts To Loved Ones Should Be Simplified Bbc News

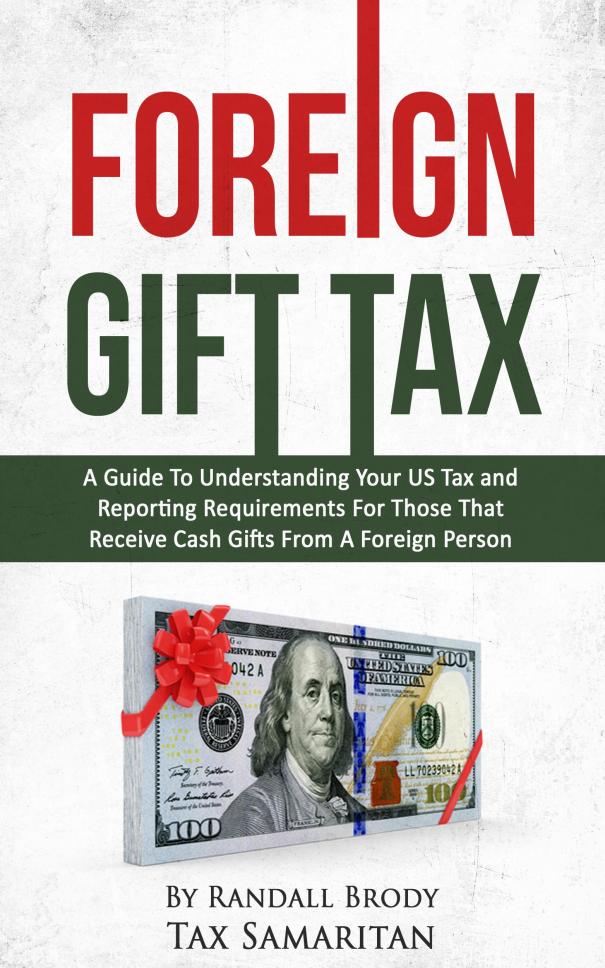

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

Presentation For Uk Us Inheritance Tax 26 07 2016

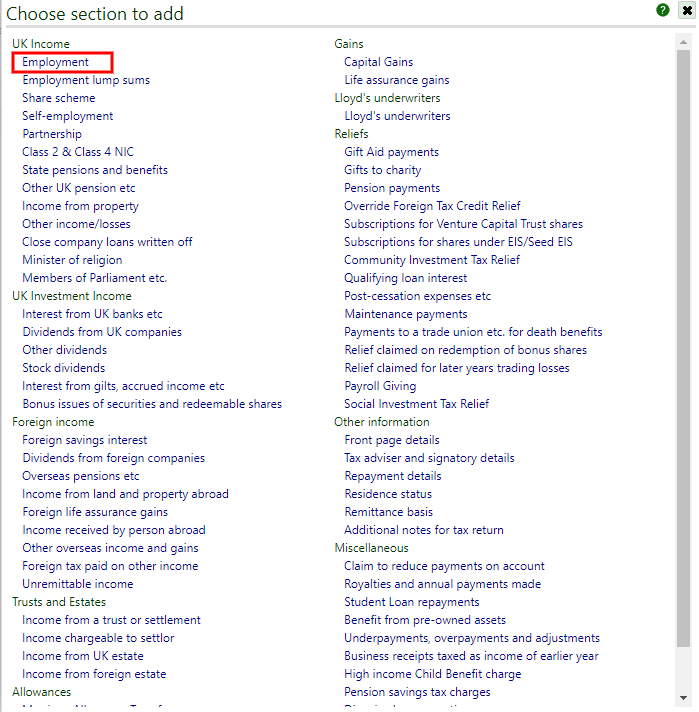

What Income Is Taxable Low Incomes Tax Reform Group

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022