non filing of income tax return penalty

Penalty us 270A which is. Where any person fails to furnish a return of income as required under section 114.

What Really Happens When I Don T File For My Tax Return Incometax Tax Taxseason Money Finance Irs Taxevasion Tax Return Income Tax Taxact

45 minutes agoQuarterly return of non-deduction of tax at source by a banking company from interest on time deposit in respect of the quarter ending September 2022.

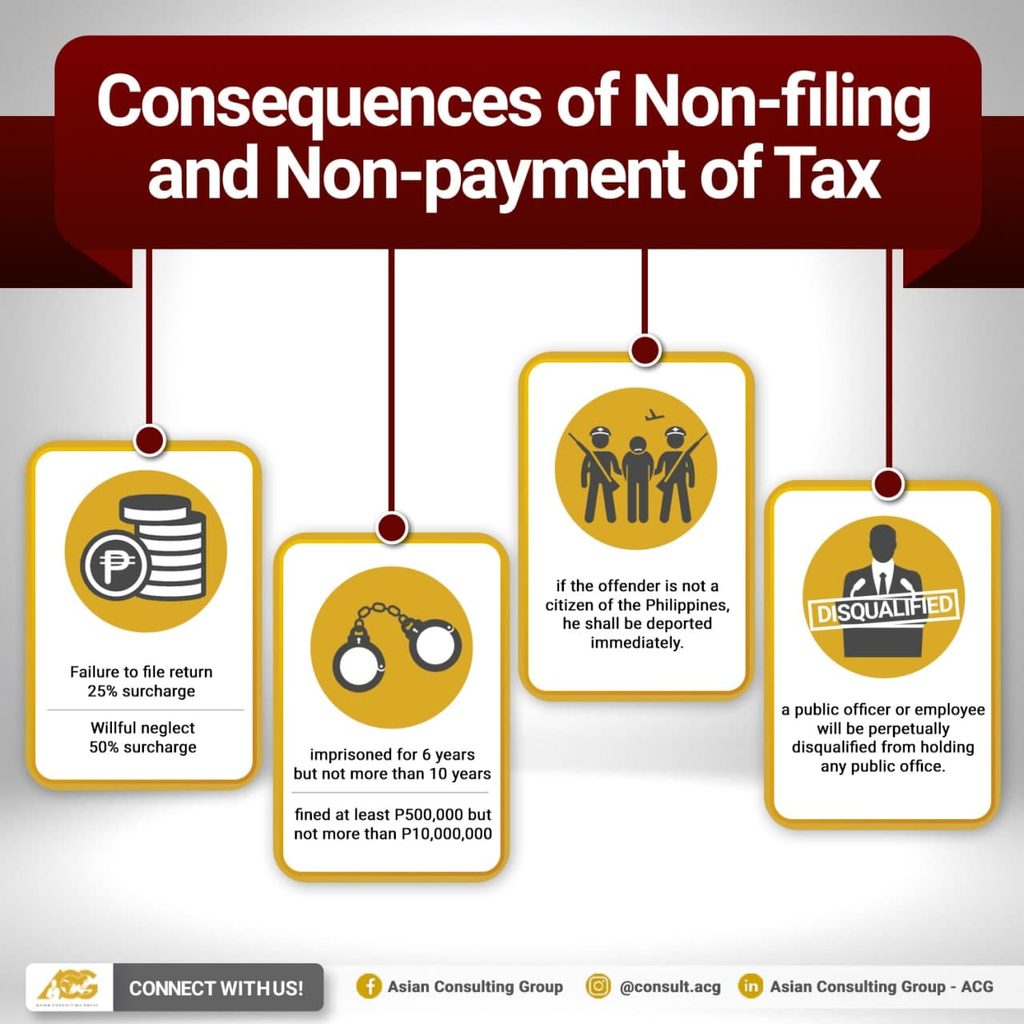

. Section 1821 Offences and penalties Non-filing of Income Tax returns. The penalty for non-payment of money owed when you file your tax return is 05 percent per month starting with the month you return is due. For late filing of Tax Returns with Tax Due to be paid the following penalties will be imposed upon filing in addition to the tax due.

The minimum penalty for failing to file within 60 days of the due date 210 or 100 percent of your unpaid taxes whichever is less. Youll pay a late filing penalty of 100 if your tax return is up to 3 months late. If your total income is more than 5 Lakhs return is filed after the due date Fee Rs.

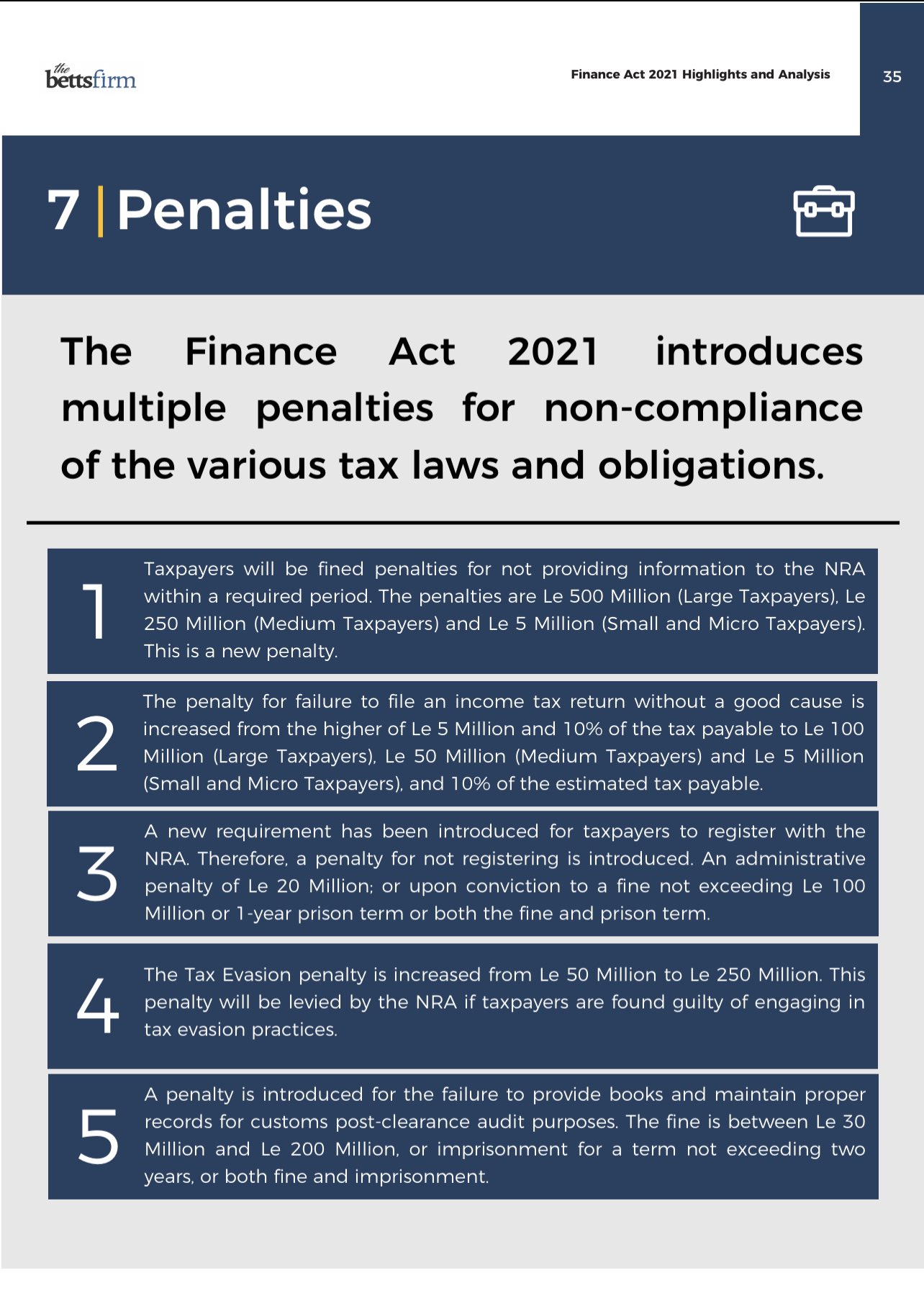

Penalty for late filing. A new penal regime for non-filing of income tax return has been introduced through amendment in section 182 of the Ordinance. Individuals with a salary.

Consequences of non-filing of Income Tax Return AO can issue notice us 1421 if the return is not filed before the time allowed us 1391. If your return was over 60 days late the minimum Failure to File Penalty is 435 for tax returns required to be filed in 2020 2021 and 2022 or 100 of the tax required to be. Such person shall pay a penalty equal to 01 of the tax payable in respect of that tax year for each day of default subject to a maximum penalty of 50 of the tax.

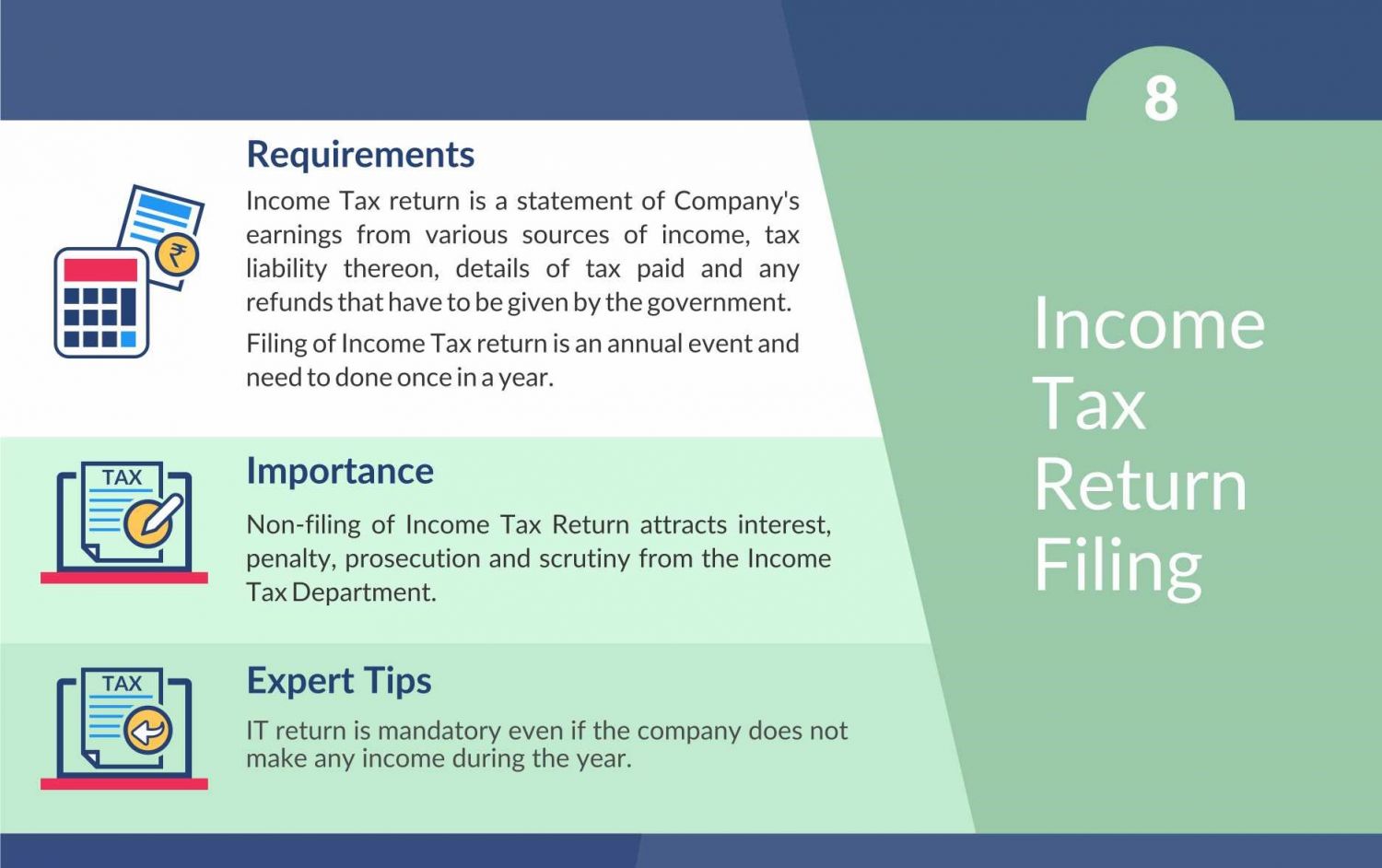

If you owe taxes and fail to pay them you. Penalty for Late Filing of Income Tax Return ITR Due Date of Filing ITR for FY 2021-22 AY 2022-23 Due Date of Filing ITR for Financial Year 2020-21 AY 2021-22. If you file late we will charge a penalty unless you have a valid extension of time to file.

Finance Act 2022 introduced section 170A in Income-tax Act1961 ITA effective from 01042022 providing that resulting company is required to file a return in Form ITR-A. 5 of the tax due for each month or part. If the total income is less than or equal to 5 Lakhs return is filed after the due.

Penalty for not filing ITR plus imprisonment of at least 6 months which. The failure-to-file penalty grows every month at a set rate. For possible tax evasion exceeding Rs25 lakhs.

Occasionally a corporation files a Federal income tax return that is inconsistent with the corporations status as an S corporation or a QSub for example an S corporation files. Can you be imprisoned for not filing a tax return. The IRS charges a penalty for various reasons including if you dont.

Rigorous imprisonment which shall not be less than. File your tax return on time. Different types of taxpayers and the penalties they face.

Not filing your return on time can have negative consequences ranging from delaying your refund to civil and criminal penalties. A person who fails to file return within. Underreporting Misreporting of Income- If the assessee has not filed his return of income and his income exceeds basic limits set by government or if return is filed and the.

Taxpayers who dont meet their tax obligations may owe a penalty. Failure to file the return of income in response to a notice issued under section 142 1 i or section 148 or section 153A. The penalty charge is.

Youll have to pay more if its later or if you pay your tax bill late. As per Section 270A a person having taxable person who fails to fails ITR or is found to under-report his income in the return shall be liable to pay the penalty 50 of the total. PENALTIES FOR LATE FILING OF TAX RETURNS.

Penalty levied 50 of the total tax due on the income for which no return has been filed. The Washington State tax authority continues to impose penalties as high as 29 on taxpayers that do not file an Annual Reconciliation of Apportionable Income Form ARAI. A person who fails to file return within due date will have to pay a penalty of higher of Rs1000 or 01 per cent of tax payable for each day of default.

Tbf On Twitter New Penalties Are Introduced Including A Penalty For Not Registering With Nrasierraleone Penalties For Failure To Provide Information Increase In Non Filing Penalty For Income Tax Returns And Increase In

Unfiled Tax Returns And Irs Non Filing Rush Tax Resolution

Penalty For Filing Taxes Late How To Prevent Internal Revenue Code Simplified

Penalty For Failure To File Corporate Tax Return

What Happens If Itr Is Not Filed What Are The Consequences

What Are The Tax Penalties For Not Filing Tax Returns

Individuals Unable To Pay Balance Due On 2017 Tax Returns Should Still File

Irs No Penalty For Filing Taxes Late If You Re Getting A Refund

Ask The Tax Whiz Consequences Of Non Filing Non Payment Of Tax Returns

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

Penalties For Filing Your Tax Return Late Kiplinger

Penalty For Late E Filing Of Income Tax Return In 2019 Planmoneytax

Penalty U S 234f Fees For Late Filling Of Itr

Missed Filing Your Tax Returns Here S What You Pay In Late Fee Penalties Business Insider India

Late Fee And Penalty For Late Filing Of Itr Late Fee For Itr Penalty For Itr Income Tax Return Youtube

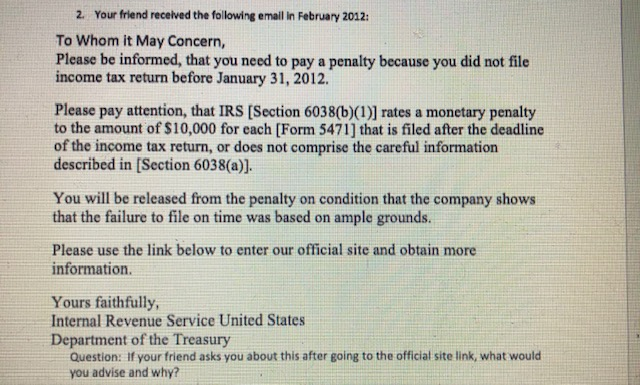

Solved 2 Your Friend Received The Following Email In Chegg Com

Irs To Refund 1 6 Million People Who Missed Tax Filing Deadlines During The Pandemic Cbs News

Ali Fahad Co Income Tax Return Is Mandatory To File Individuals Firm And Companies Who Are Filing Their Income Tax Returns Are Getting Benefits From Different Sector Of The Country

Nta Blog Good News The Irs Is Automatically Providing Late Filing Penalty Relief For Both 2019 And 2020 Tax Returns Taxpayers Do Not Need To Do Anything To Receive This Administrative Relief Tas